|

Dear Friends,

I am beginning this newsletter with exciting news. New South won two prestigious awards in the month of August.

First, we were selected as one of the Best Companies to Work or in South Carolina, an award that is presented by SC Biz Magazine and the SC Chamber of Commerce. Given “The Great Resignation”, it is even more gratifying to see our Associates are so happy with their careers with us. We know to attract and retain high quality Associates, we need to provide a high-quality workplace. I am happy to see we are on the right track.

Second, we were named to the Fastest Growing Companies in South Carolina list. Since the start of the pandemic, we have had to deal with a lot: showroom shutdowns, product shortages, rampant inflation — to name a few of the challenges we have faced. To be able to manage hypergrowth during this time has been a total team effort. Our Customers, Associates, and Suppliers all came together to make this award possible.

Next, below is the latest in construction pricing. The two-year run of steady increase on construction commodity products has finally peaked, and there is now a downward trending pattern for not all, but many commodity-based items. See below for more details.

Lumber is a commodity that continues to stay stuck on the bottom. Mill demands are low with buyers mainly purchasing immediate needs only. With sitting inventory available and lead times only running one to two weeks, mills are having a hard time selling at printed numbers. A month or less supply of sitting inventory seems to be the current market norm, as no major buyers see a significant rise in short term pricing that would drive industry purchase levels up. We expect lumber to remain at these lower levels for at least another few weeks.

Wire mesh reinforcing also continues to soften. With July’s lower levels of purchases, mills appear to have ample amounts of sitting inventory and are looking to move product off the yard. Positively for the mills, the large volume of distributors with sitting inventory stockpiled over the last few years has begun to dwindle down. This reduction in distributor inventory is resulting in an uptick of purchases for material being placed in the past few weeks. This increase in submitted purchase orders is not enough to shift the overall downward trend, but does seem to be slowing it some. Another positive with the current mesh market is lead time. Production is not nearly the issue it has been and lead times are mostly based on trucking availability. Lead times are only one to two weeks for most standard sizes.

The rebar market is similarly experiencing a softening over the past month. While not a dramatic as wire mesh, the availability of sitting inventory and pressure from importers, has provided some pricing relief on domestic rebar. Mills are still boasting full rolling schedules, but most distributor and fabricator needs are being fulfilled relatively quickly. Lead times for individual trucks are roughly two weeks, with multiple truckload orders being filled based on posted rolling schedules. Fabrication backlogs remain strong with most fabricators still booked out for months, but the day to day 20’ stock length (mainly residential) consumption levels are softening. There is no anticipation for a single significant drop in pricing, but more of a slow gradual decline over the coming months.

Lastly, polyethylene sheeting is likewise seeing price retraction. Poly has been relatively stable over the past few months but is now currently seeing overall demand soften. Lower oil pricing and softening market demand has allowed mills to catch up on production resulting in shorter lead times. Shorter lead times are reducing the volume of large purchase orders that generally keep pricing stable. This softening is still new to the market and distributors will have to work through sitting inventory before the softer prices work their way through the supply chain.

Contractors’ input costs declined on balance in July, while bid prices accelerated, according to Bureau of Labor Statistics (BLS) data posted on August 11. Specifically, the producer price index (PPI) for material and service inputs to new nonresidential construction slid 1.3% for the month, while the PPI for new nonresidential building construction—a measure of the price that contractors say they would bid to build a fixed set of buildings—jumped 5.4%. The input index climbed 14.6% year-over-year (y/y), but that was the smallest y/y rise since March 2021. The bid-price index rose by a record 23.9% y/y. Several materials contributed to the slowing of input costs. The PPI for diesel fuel plunged 16.3% in July but soared 71.3% y/y. Indexes for metals fell for the month: copper and brass mill shapes -9.7% (and -7.9% y/y); aluminum mill shapes, -4.0% (but up 12.5% y/y); and steel mill products, -3.7% (up 6.4% y/y). Other inputs with small declines in July include lumber and plywood, -0.5% (and -7.7% y/y); truck transportation of freight, -0.3% (but up 21.7% y/y); and asphalt felts and coatings, -0.2% (up 17.8% y/y). Prices increased in July for several inputs, including insulation materials, 3.3% (and 19.0% y/y); concrete products, 2.2% (and 14.3% y/y); and plastic construction products, 1.0% (and 22.4% y/y). AGC posted tables of construction PPIs.

Click here for the latest update on the construction economy from Ken Simonson, the chief economist of the AGC.

|

Catching up with our Customers

This month, we are catching up with the team over at Pride Masonry, based out of Spartanburg, South Carolina. Pride Masonry was established in South Carolina by James Davis, who retired in 2016, at which time he entered a buy/sell agreement with Brian Miller. Their preconstruction department has three phenomenal estimators with over 100 years of experience. In the field, they have nine crews and a dedicated maintenance/renovation division. To learn more about them, click here.

Featured Manufacturers

Owens Corning

Premier supplier of insulation, roofing, and fiberglass composites

Access Tile

The ultimate solution in detectable warning systems

SpecChem

Makers of Chemicals and Aggregates for the Concrete Industry

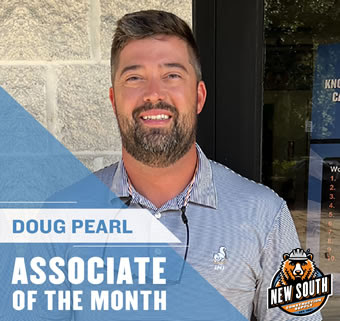

Associate Profile

Doug Pearl

Sales Manager, Charleston, SC

Our Associate Spotlight this month is of Doug Pearl, a Sales Manager in our N. Charleston, SC branch. Doug was born in Tampa, FL, graduated from Andrews High School in High Point, NC, and he earned a B.S. Degree in Computer Information Systems from Pfeiffer University in North Carolina. He started with New South in February 2022, specializing in tilt up construction sales. Prior to joining us, Doug was with United Rentals for nine years as an Account Manager, and prior to that position, was with American Concrete Construction for seven years as a Project Manager/Estimator. He and his wife, Lauren have two daughters, Lindley and Presley. His hobbies are golf, CrossFit and boating. Overall, Doug grew up in the concrete business and is glad to be back in the industry. We are glad to have him back in the industry as well as he hit the ground running faster than anyone we have ever hired.

Our leadership article this month is my column in the Upstate Business Journal this month on the power of 1:1 monthly meetings with those who report to you. In this age of email/texts/cell phones, a face-to-face meeting with all who report to you for an hour or so a month helps ensure there have been no miscommunications over the last month and keeps you and your reports fully aligned. Click here to read the article.

Lessons from the Trenches:

Monthly Meetings

Well, summer is winding down and I know we will all welcome some cooler weather after a particularly hot and humid simmer here in the southeast. I hope business continues to be good for you and remember we are always interested in knowing how we can better serve you.

Best regards,

Jim Sobeck

President & CEO 864-263-4377 (Direct Line)

[email protected]

Main Office/Branch: Greenville, SC

Other Branches in:

Columbia | Charleston | Myrtle Beach | Hilton Head | Greensboro | Raleigh | Charlotte | Atlanta | Jacksonville

Connect with us:Instagram I Facebook I LinkedInI Twitter | YouTube

Author ofThe Real Business 101: Lessons From the Trenches.To get your copy see below:

For Smashwords (eBook version for Kindle, iPad, Nook) click here

For direct link to Amazon site (Kindle and print version) click here

|